Ethereum Price Prediction: Will ETH Reach $5,000 Amid Market Volatility?

#ETH

- ETH trades below key moving average with bearish MACD signaling ongoing pressure

- Market sentiment divided between institutional accumulation and liquidation concerns

- $4,100 support test critical for determining short-term price direction

ETH Price Prediction

Ethereum Technical Analysis: Key Levels to Watch

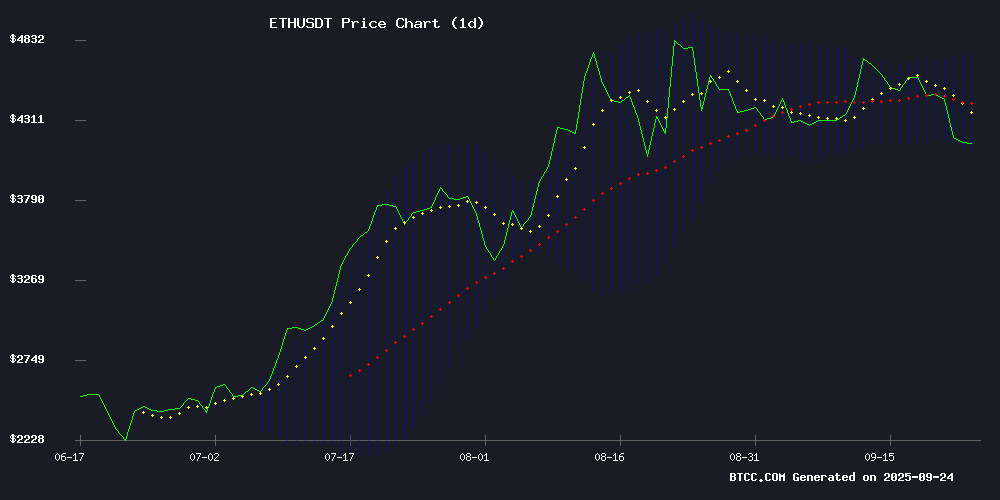

ETH is currently trading at $4,183.71, below its 20-day moving average of $4,421.94, indicating short-term bearish pressure. The MACD shows negative values with the histogram at -5.24, suggesting ongoing downward momentum. Bollinger Bands place immediate resistance at $4,741.32 and support at $4,102.56. 'ETH needs to reclaim the $4,421 level to signal a potential reversal,' says BTCC financial analyst Emma.

Mixed Sentiment as Ethereum Faces Critical Juncture

Market sentiment reflects uncertainty with contrasting developments. While ETHZilla's $350M L2 investment and whale accumulation of $1B signal institutional confidence, concerns over centralization criticism and the largest liquidation wave since 2021 create headwinds. 'The $4,100 support test will be decisive for short-term direction,' notes BTCC financial analyst Emma, aligning with technical indicators showing key resistance walls.

Factors Influencing ETH's Price

Ethereum's October Outlook: A Historical Perspective

Market calendars and seasonality often defy investor expectations in the volatile crypto space. ethereum (ETH -0.73%) enters October with tempered optimism, historically positioned as a transitional month between soft September performances and stronger November rallies.

Since its launch, Ethereum's median October return stands at a modest 0.5%, with an average gain of 4.7%. These figures suggest a month of consolidation rather than dramatic price action. "October tends to be an appetizer," the data shows, preceding Ethereum's typically robust fourth-quarter performance.

Disciplined investors accumulating positions through dollar-cost averaging may find this period favorable. While the median return appears subdued, the distribution of outcomes reminds us that exceptions occur. The current market context - including macroeconomic factors and network upgrades - will ultimately determine whether October 2023 follows historical patterns or writes its own narrative.

ETHZilla Secures $350M Funding to Expand Ethereum L2 Investments

ETHZilla Corporation has bolstered its financial position with a $350 million issuance of convertible debentures, signaling strong institutional confidence in its Ethereum Layer 2 expansion strategy. The capital raise follows an amended agreement with an existing investor, extending favorable terms on previous debt instruments.

The restructured deal maintains 0% interest on $156.5 million of outstanding convertible debentures until February 2026, after which they'll accrue a reduced 2% annual rate—half the original 4% terms. New debentures mirror this 2% rate, with the company positioned to leverage interest arbitrage across its $500 million portfolio of yield-bearing assets.

"This financing structure reflects our disciplined approach to capital allocation in the L2 ecosystem," said Chairman and CEO McAndrew Rudisill. The strengthened balance sheet combines ETH reserves, cash equivalents, and protocol tokens, providing runway for strategic deployments.

Ethereum Faces Resistance Wall Amid Market Uncertainty

Ethereum's price action shows signs of strain as it struggles to hold above key support levels. The second-largest cryptocurrency failed to sustain momentum above $4,500, triggering a decline that breached multiple support zones. Current trading below $4,220 and the 100-hour moving average suggests bearish control.

Technical indicators reveal a critical juncture. A bearish trend line has formed with resistance NEAR $4,370 on ETH/USD charts, while the $4,125 support level hangs in the balance. Market participants are watching Fibonacci retracement levels closely, particularly the 50% level at $4,315 from the recent swing high of $4,636 to the $4,000 low.

The immediate outlook remains precarious. A decisive break below $4,125 could accelerate declines, while reclaiming $4,280 might signal renewed bullish interest. This price action mirrors broader market trends, with Bitcoin showing similar weakness in recent sessions.

Vitalik Buterin Defends Ethereum L2 Base Against Centralization Criticism

Ethereum co-founder Vitalik Buterin has publicly supported Base, a LAYER 2 solution, following allegations of centralization risks. Critics argued that Base operates as an unregistered securities exchange due to Coinbase's control over its sequencer—a centralized component that prioritizes transaction orders. Max Resnick of Anza Economics suggested this structure warrants regulatory scrutiny.

Buterin countered these claims, emphasizing Base's non-custodial design. "Base cannot steal funds or block withdrawals," he stated, highlighting the L2's reliance on Ethereum's mainnet for security. Users retain the ability to withdraw assets even if Base ceases operations—a safeguard inherent to Ethereum's decentralized settlement layer.

The debate underscores growing tensions between scalability solutions and decentralization purists. While Base exemplifies Ethereum's "stage 1" scaling approach, its hybrid architecture continues to spark discussions about the tradeoffs between efficiency and trustlessness in blockchain infrastructure.

Ethereum Risks Losing $4,000 as Bearish Pressure Mounts

Ethereum's price has slumped to $4,185, marking a 5% decline as bearish momentum accelerates. The breakdown from a symmetrical triangle pattern has dashed hopes of an upward breakout, with resistance at $4,600 proving insurmountable. Traders now brace for further downside.

Technical indicators paint a grim picture. The 50-day moving average has been breached, leaving the 100-day average near $3,880 as the next line of defense. A failure to hold this level could see ETH test $3,378—a move that WOULD erase most of its summer gains. The $4,000 threshold looms large as both psychological and technical support.

Selling pressure is intensifying, with volume spikes confirming bearish dominance. The RSI's dip below 40 signals oversold conditions, but any relief rally would face stiff resistance at $4,400. Market sentiment hinges on ETH's ability to defend $4,000—a breach could trigger accelerated selling.

Ethereum Faces Critical Support Test After Wedge Breakout

Ethereum's price action stands at a pivotal juncture following its breakout from a rising wedge pattern—a technical formation often signaling bearish reversals. The initial upward surge sparked optimism, but the true test lies in the retest of the $3,900–$4,100 support zone. A successful hold could pave the way for a rally toward $4,887, while failure may RENDER the breakout a false alarm.

Crypto analyst The Boss notes the significance of this retest, emphasizing that reclaimed resistance-turned-support levels often dictate future momentum. Meanwhile, crypto Candy underscores that all-time high targets remain viable as long as ETH maintains its footing above key support. Market participants await confirmation—will Ethereum's breakout prove resilient or falter under pressure?

Whales Place $1B Bet on Ethereum Rebound Amid 20% Slide

Ethereum's price tumbled 20% from its Q3 high of $4,900, testing the $4,000 support level as institutional outflows accelerated. ETF redemptions hit $76 million in 24 hours, with BlackRock offloading $15.1 million in ETH and market makers like Wintermute executing aggressive repositioning on Binance.

Contrary to the bearish momentum, on-chain data reveals a whale accumulating $1 billion in long positions. Trading volume spiked to $40.5 billion, while analysts note historical patterns where such flush-outs precede Q4 rallies. The market appears poised for continued volatility before a potential year-end rebound.

Ethereum Retests $4,100 Support After $490 Million Leverage Liquidation

Ethereum's price dipped to $4,160 amid a cascade of long liquidations totaling $490 million, marking one of the largest leverage flushes in 2025. The sell-off was amplified by overcrowded futures positions, with open interest surging by 890K ETH over the weekend before Monday's 7% decline.

Despite the leverage-driven volatility, on-chain data reveals dip-buying outpaced distribution—a sign investors view the pullback as an accumulation opportunity. ETH now tests critical support near $4,100 as technical indicators flash oversold conditions.

"Crowded longs turned a minor correction into a cascading liquidation event," noted Shawn Young, Chief Analyst at MEXC. Funding rates turned negative during the unwind, though actual liquidations may exceed reported figures due to exchange reporting delays.

Ethereum Price Prediction and Remittix's Rise in DeFi

Ethereum's price volatility remains a focal point for traders as ETH fluctuates between $4,100 and $4,700, testing key demand zones. Analysts suggest a potential recovery toward $5,000, bolstered by strong staking activity and DeFi fundamentals.

Meanwhile, Remittix has emerged as a viral contender, attracting nearly 40,000 presale holders and raising $26.3 million. The project's rapid adoption signals growing competition in the DeFi space, potentially challenging Ethereum's dominance by 2025.

Analyst Predicts Ethereum Price Will Reach $33,000 As ETH Founder Forecasts ‘Google Moment’

Ethereum is capturing market attention as analysts and founder Vitalik Buterin make bold predictions. Egrag Crypto's chart analysis suggests ETH could surge to $33,000 by 2025, citing historical patterns like Bull Flags and Rectangle Continuations that previously delivered 145% and 181% overshoots. The current Descending Broadening Wedge formation hints at another potential breakout.

Buterin draws parallels between Ethereum's future in finance and Google's search dominance, suggesting low-risk DeFi could be ETH's "Google Moment." The narrative combines technical analysis with visionary adoption scenarios, positioning Ethereum at the intersection of market momentum and structural innovation.

Ether Suffers Largest Liquidation Wave Since 2021 as Crypto Markets Tumble

Ethereum led a brutal selloff across digital assets, triggering its most severe liquidation event in three years. The second-largest cryptocurrency plunged toward $4,000 amid a broader market downturn that erased nearly $3 billion in Leveraged positions.

On-chain data reveals ETH long positions bore the brunt of the deleveraging. The scale of liquidations suggests excessive speculative activity had built up in derivatives markets prior to the correction. Such violent unwinds typically signal capitulation among overleveraged traders.

While altcoins across the board felt pressure, Ethereum's market structure appears particularly vulnerable. The liquidation storm raises questions about whether current price levels can hold without further deleveraging. Market makers now watch for whether this flushout establishes a durable bottom or precedes additional downside.

Will ETH Price Hit 5000?

Based on current technical and fundamental analysis, reaching $5,000 in the immediate term appears challenging. ETH would need to overcome significant resistance levels and reverse the current bearish momentum. However, several factors could influence this trajectory:

| Factor | Current Status | Impact on $5,000 Target |

|---|---|---|

| Technical Resistance | $4,741 (Upper Bollinger Band) | High - Must break above |

| Market Sentiment | Mixed with bearish pressure | Medium - Needs improvement |

| Institutional Support | Strong ($1B whale accumulation) | Positive long-term |

| Liquidation Pressure | High ($490M recent liquidations) | Short-term negative |

'While the $5,000 level remains a possibility, ETH must first stabilize above $4,400 and build momentum,' explains BTCC financial analyst Emma.